Cover image credit: 1201 sn2 by thedailyenglishshow is licensed under CC BY 2.0.

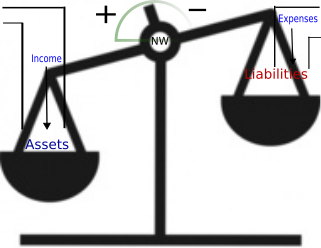

We define “financial sustainability” (FS) as not running out of money, i.e., keeping your net worth (NW) positive1 over a sustained period of time. The concept of FS is similar to what’s referred to in popular culture as “financial independence”, but a bit broader2.

Cash flow

NW, the most important quantity in personal finance, is not a static quantity, but rather it dynamically evolves over time. How it changes over time is primarily determined by what’s known as your “cash flow”, i.e., money that flows into your assets and your liabilities.

Your cash flow consists of two components, as shown in the figure:

- your income, which adds to your assets, and

- your expenses, which adds to your liabilities.

So, FS basically boils down to having your income exceed your expenses.

Now let’s look at each of the two components of cash flow more closely.

Law of interest proportionality

There are two main ways to generate income:

- in exchange for your time & labor, and

- making your money work for you.

The income generated through the first approach, which typically takes the form of a salary, is known as “active income”3. As you can probably guess, the latter type of income is known as “passive income”.

Passive income is directly proportional to the amount of money working for you, a.k.a. your “working capital”.

In other words, the higher your working capital, the higher the passive income it can generate for you4. This is a fundamental principle of investment returns, and is simply a generalization of the law of interest proportionality.

Therefore, if you want to be able to live off your passive income alone, you need to first have a sizeable amount of working capital. Unless you already have such an amount, e.g., through a substantial inheritance, you have to use the first option to generate sufficient active income to pay for your living expenses, and build your working capital. If you can’t generate sufficient income to pay for your living expenses, your situation is not financially sustainable, and that’s a recipe for financial stress.

It’s also important to remember that in many countries, passive income is usually taxed more favorably than active income5. This allows you to keep more of the passive income you generate than you would if you generated the same amount of active income. Thus,

making your money work for you is much more advantageous than you working for money!

Expense streams

Now, let’s look at the other component of cash flow, viz., expenses. Conventional wisdom states that all your expenses can be classified into two categories: needs and wants. This is a false dichotomy, and it’s much better to conceptualize your living expenses as lying on a “reqs” spectrum.

Nonetheless, what remains true is that the lower your expenses, the lower the income level you need to sustain your expenses, which in turn means the earlier in your financial journey you can become financially sustainable. Since your expenses are more directly within your control than your income6, your total expenditure level is the most important factor that determines when – and if – you’ll attain FS.

Another common pitfall when approaching expense streams is to go with the standard ones that are found in most budgeting templates. However, this one-size-fits-all is not a good way to categorize your expenses.

To summarize, maintaining a low expenditure level is the key to achieve FS.

-

i.e., your assets must exceed your liabilities as seen in the NW scale ↩︎

-

The difference between financial sustainability and financial independence is that the former is deals with your total income whereas the latter only considers income not derived from your main work, e.g., your job. ↩︎

-

so called since you have to actively work for it ↩︎

-

in all practically relevant cases we’re aware of ↩︎

-

e.g., you don’t need to pay payroll taxes, etc. in the US on investment income ↩︎

-

since income is determined, among other factors, by the local supply and demand of your skill-set, the local cost of living, etc. which are not within your control, but you can decide what to spend your money and what not to spend it on ↩︎