Cover image credit: Balance Scale by Sepehr Ehsani is licensed under CC BY-NC-ND 2.0.

One of the most important quantities in personal finance is what’s known as your “net worth” (NW). So what is your NW?

Quite simply, your NW what you own minus what you owe.

For example, if you only own a house worth 100,000 LCU, but owe a loan on it for 80,000 LCU1, your NW (in LCU) is:

$$ \begin{equation} 100,000 - 80,000 = 20,000. \end{equation} $$

Before we go any further, it’s important to emphasize that this technical definition of NW has nothing to do with its literal meaning. In other words, your worth as an individual has nothing to do with what’s defined as NW in the financial sense.

Why is NW such an important quantity in personal Finance?

The reason why NW is so important is that it allows you to cut through all superfluous details to really get an accurate picture of your financial situation. For example, if you drive a fancy car, and live in a fancy house in a fancy part of town, you may be able to give off the appearance of being very wealthy to others (and even convince yourself that you are, in fact, loaded with money!). However, if you had to take out a loan to buy your fancy car and house, and have barely enough money to support your fancy lifestyle along with paying down your loan, then in reality your NW is very low. That is, you’re actually not as wealthy as you might think or lead others to believe!

Thus, NW can serve as the mirror that faithfully reflects your financial picture.

Keep in mind that NW is a snapshot-in-time picture of your financial situation. If your NW today is higher than it was a year ago, it means you’re richer today than you were a year ago. Similarly, if your NW today is lower than it was a year ago, you’re actually poorer today than you were a year ago.

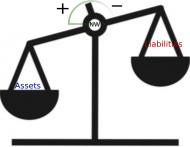

The two quantities that define NW, viz., what you own and what you owe, are called “assets” and “liabilities” respectively. To grasp the concept of NW more intuitively, it’s helpful to visualize your NW as a balance with assets on one side and liabilities on the other.

When your assets exceed in value to your liabilities, you can, if you wish, pay off all your debts, and still have some money left over. On the other hand, if your liabilities exceed your assets in value, you cannot nullify all your liabilities with your assets. As the NW visualization above shows, the value of your NW can be gleaned from the dial above the NW scale.

The inability to satisfy all your liabilities is one of the leading causes of financial stress. Financial success basically boils down to keeping this single number, viz., NW, consistently increasing2 over long periods of time (except, possibly towards the end of your life).