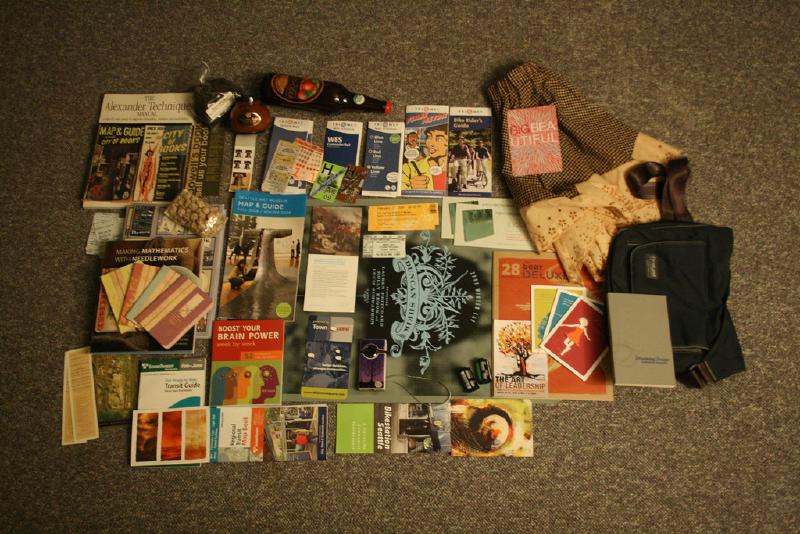

Cover image credit: “Cascadia Trip Accumulation” by sillygwailo is licensed under CC BY 2.0.

Who doesn’t want tons of money coming in automatically while all they do is relax and enjoy life or pursue other meaningful activities1?

It is almost every person’s dream to have enough passive income to comfortably fund their lifestyle forever so that they can focus on other more interesting things in life than their boring day job. Not too long ago, a movement started gathering momentum online whose focus is on achieving this state of affairs as quickly as possible, dubbed “FIRE” (an acronym for Financial Independence Retire Early). Inspired by the success of the early proponents of this movement, who were able to do precisely what the FIRE concept espoused, viz., walk away from their day jobs feeling comfortable in the knowledge that their passive income would be enough to pay for their living expenses, many folks started jumping onto the bandwagon, especially in more recent times. Now this concept has captured the public imagination so much that there is a plethora of blogs, articles, social media accounts, websites, etc. devoted to this topic, complete with FIRE celebrities, retreats, courses, and what-have-you!

Before you jump in to try achieving financial independence (FI) yourself, however, it’s worth considering if there’s a danger of burning out in the process.

Conventional FI

For most people2, accumulating enough money to last forever typically takes a very long time3. How long will it take for you to become FI depends mainly on how much you’re making compared to how much you’re spending, i.e., your savings4 proportion. Basically, the higher your savings proportion, the earlier you can achieve FI.

However, high-paying jobs tend to be located in cities with a high cost of living5, where it’s very difficult to keep your living expenses low without making a lot of sacrifices in your daily life.

On the other hand, if you live in a place with a low-to-moderate cost of living to keep your living expenses low, there usually aren’t many high-paying jobs available to you6. In either case, if you’re starting from very little and are a typical salaried employee, you’d need decades to accumulate enough to be anywhere near FI. Furthermore, if you had any debt when you started working7, FI would be an even longer journey for you.

But given that you won’t live forever8, what is the point of having enough money to last forever?

Shortcomings of conventional FI

Many proponents of FI argue that being financially independent is like having insurance against the worst possible financial situations, e.g., the depression of the 1930s or the recession of 2008. This argument is flawed for two reasons.

Firstly, history doesn’t repeat itself. Just because the amount needed for FI would have been enough to see you through the worst of the financial crises of the past, it doesn’t mean that it would be enough for future crises too.

Secondly and more importantly, you can’t get back the years you spent in the pursuit of FI. After all, YOLO (You Only Live Once)! For most of us, these years tend to be some of the most productive ones of our lives.

In light of this simple truth, one can argue that the insurance that FI affords is too expensive.

So should we just abandon the notion of FI and live paycheck-to-paycheck?

We don’t think so! In another post, we’ll see that there’s another way to approach the issue of having enough income that has the advantage of focusing on your financial journey rather than only the end goal.

-

which would potentially produce no income ↩︎

-

other than those born with a silver spoon in their mouths ↩︎

-

if it didn’t, most of us wouldn’t be working dreary jobs or reading about FI! ↩︎

-

and, to a lesser extent, on how you invest ↩︎

-

e.g., New York City, London, San Francisco, Tokyo, etc. ↩︎

-

This remains true despite the recent pandemic, which made remote working more commonplace, primarily due to the commonplace practice by employers to pay their employees based on where they’re located instead of solely based on their job responsibilities ↩︎

-

e.g., student loan debt, which is very common nowadays ↩︎

-

at least until we discover how to become immortal, and even then, we may not want to live forever ↩︎